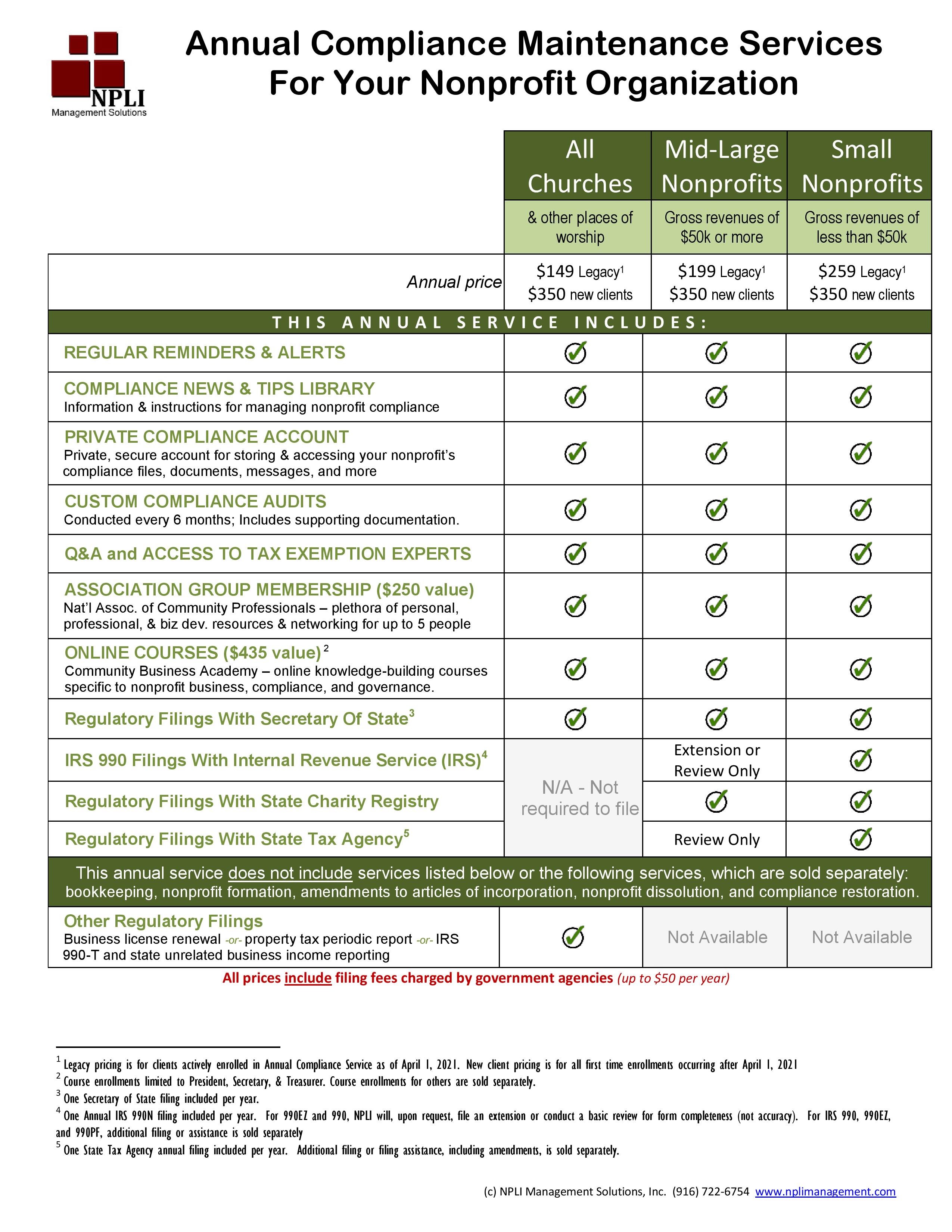

ANNUAL COMPLIANCE MAINTENANCE

Small Price. Huge Piece of Mind.

The single biggest threat to a nonprofit's existence, including churches, is its ability or inability to remain in 100% compliance with the IRS and state agencies that regulate charities and other tax exempt organizations.

We've helped hundreds of nonprofits maintain and restore their state and federal compliance, including revoked 501c3. And, we would love to be your compliance partner too. Even if your nonprofit is okay in this area, with our annual compliance maintenance service you'll have extra peace of mind and support.

What's Included? What is the Cost?

Pitfalls cause problems such as costly penalties, fines, and can even result in the nonprofit losing its tax exempt status; and losing the right to conduct business or even use its name.

With our expertise, you can be confident that any compliance issues will be identified and addressed. And you'11 have the piece of mind in knowing that all paperwork will be filed correctly and quickly. Even if you've started some of the process before working with us, we'll evaluate what you've completed and work with you to complete any and all remaining steps, including making any corrections that may be needed.

PITFALL# 1Assuming the IRS 990 is the only required annual filingHow we work with you to avoid this pitfall →From the moment you enroll, we provide you with easy-to-understand information and instructions explaining which government agencies regulate your nonprofit and what is needed to restore or maintain compliance with them. |

|

| PITFALL# 2Assuming everything is okay; but not having any documentation to support the assumptionHow we work with you to avoid this pitfall →We conduct a comprehensive compliance audit within 5 days of your enrollment and another one in six months. The custom compliance audit provides you with a quick overview of your nonprofit's status with all state and federal agencies that regulate charitable and other tax exempt organizations.

|

PITFALL# 3Assuming Compliance is only about filing paperwork once a yearHow we work with you to avoid this pitfall → Each month you will receive a reminder, as well as, tips and news to keep you and your team fully abreast of compliance matters relating to your specific type of nonprofit.

|

|

| PITFALL# 4Failing to File with the State Tax AgencyHow we work with you to avoid this pitfall →At least 1 month before any required filing or report is due, we will notify you with details for what needs to filed, why, and with which agency or agencies.

|

PITFALL# 5Failing to File with the Office of Attorney GeneralHow we work with you to avoid this pitfall →At least 1 month before any required filing or report is due, we will notify you with details for what needs to filed, why, and with which agency or agencies.

|

|

What's Included? What's the Cost?

Custom Compliance Audit Complete review with documentation of status with regulatory agencies.

Tips, education, & Resources To keep you informed about nonprofit compliance & business matters

|

Priority Response Receive top priority support & response by phone, email, in-person, online chat, and text

Alerts & Reminders Friendly reminders and high priority alerts as needed for an unlimited number of your team members.

|

Privacy & Confidentiality Your information is always securely stored and is never shared with others.

Regulatory Filings Timely and accurate filings of reports and tax returns. And you receive all copies of all documents filed. |

Gross Revenues $51K - $200K

Annual Tax Returns - $325 additional fee - includes filing IRS 990ez; and state tax returns, and charitable reports (Office of Attorney General).

Gross Revenues Over $200K

Annual Tax Returns - $850 additional fee - includes filing IRS 990ez; and state tax returns, and charitable reports (Office of Attorney General).